February 1, 2022

As a mortgage servicer, it might feel like the whole world is out to get you, constantly criticizing you for what you should or shouldn’t be doing.

“You had 2 years to prepare, why aren’t you ready yet?”

Over the last two years, you have managed a number of changing rules from the different government agencies by creating new workflows and training your staff. Only to scrap those workflows and create new ones as the next rule comes out – over and over. Add in new and unforeseen market conditions, and the situation gets even more complicated.

From rising interest rates to inflation, changing market conditions are causing unexpected consequences. In the past, borrowers could refinance out of their troubles with equity. But with rates and inflation increasing, the ability to refinance is getting harder, and a rising cost of living creates an even trickier situation.

There is no doubt that uncertainty, our new least favorite word, is the biggest factor at play here.

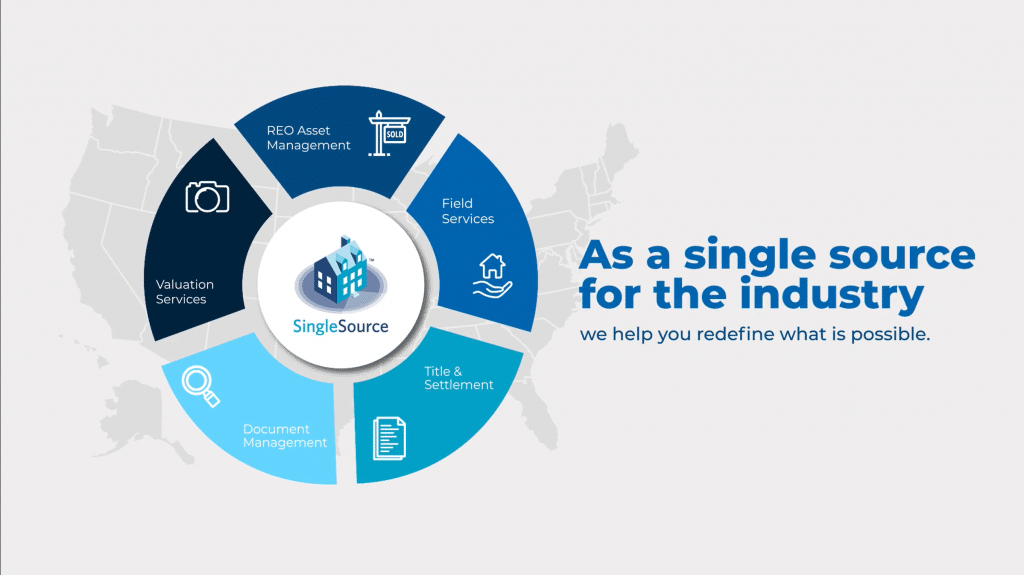

Using one servicing partner offers you a seamless workflow, which leads to better communication across all parties, quality results, and faster turnaround times. Not to mention, one less thing to manage during an already complex environment of changing guidelines.

Let’s explore the familiar process of what needs to be evaluated before REO.

Valuation Solutions

Before anything begins you will order a valuation to ensure the value is justified to go into foreclosure. From a full appraisal to BPOs, AVMs, and the popular range of hybrid valuations, there are a variety of options to choose from, based on each property’s unique situation and risk profile.

And as a national AMC, SingleSource ensures the highest quality valuation product and regulatory compliance. Throughout this process, SingleSource is highly flexible with our customers’ requirements. We can look at the value every 30 days, 90 days, or another option – you dictate the timeline.

Title & Settlement Solutions

Next, title comes into play. Property reports, foreclosure title searches, preliminary judicial reports, and more, should be ordered to ensure there are no unexpected liens and make sure you understand the nuances of each property. SingleSource adheres to each state’s unique timeframes for all title searches.

The SingleSource Title team works closely with our asset management team, valuations, and field services teams to provide all groups with a single source of truth when it comes to the information about each property.

And once the file is in REO, we can issue a full title search commitment and subsequently close. One seamless process from start to finish.

Field Services and Inspections

Arguably one of the most important steps in terms of risk management is property preservation services and mortgage inspection activities. The initial occupancy inspection sets the stage for all mortgage field services moving forward. Our inspection department provides a wide range of options, from door knockers to drive-by inspections.

As a national field service company, our internal counsel and field service teams maintain and update investor/insurer requirements in real-time; our systems are driven by rules that we build to ensure our clients’ properties are properly maintained. We also offer clients a direct Escalation Representative to handle exception management with focus and attention.

Our dedicated lockout team handles all possessory actions from lockouts, cash for keys (CFKs), and moves to storage. In addition, we have specialized loss mitigation teams that monitor potential and active code violations and maintain a property registration database to ensure properties are registered and renewed. These teams handle municipal operations to altogether avoid and/or reduce the cost and risks associated with these requirements for our clients.

REO Asset Management

The SingleSource REO Asset Managers get involved at different stages of this process depending on the client. Sometimes they will join as the eviction is occurring, or other times when the property is already vacant after the occupancy inspection.

From foreclosure sale through liquidation or at any point in-between – we understand that time is money. Our experienced Asset Managers have extensive experience managing a range of loan profiles: whole-owned, GSE, FHA, USDA, VA, or private investors – we understand each guideline and coordinate all activities across the varying products with those requirements in mind. You no longer have to manage the coordination between multiple vendors when everything is in one location – we do that process for you.

Each Asset Manager ensures smooth coordination of services, helps to guarantee your highly sensitive deadlines are met, and serves as your expert advisor through the entire process.

Wrap up

Using one vendor partner to provide end-to-end mortgage servicing solutions has many unique advantages during the default process. We pride ourselves in being positioned as the single source for all national default servicing activities in the industry, by offering and coordinating services across the full process to help you meet your servicing needs and objectives.

To learn more about the SingleSource Servicing solutions, click here.

Stay tuned for exciting updates on our new servicing solution technology platform – coming soon!